Record Reverse Mortgage Rates

The addition of a 2nd reverse mortgage provider

combined with the COVID-19 pandemic has been a catalyst in setting record low reverse mortgage rates which provide a steady stream of cash flow for baby boomers who have worked hard enough in their life but simply have not been able to save enough money to enjoy their golden years.

Reverse mortgages allow homeowners over 55 years old to receive funds monthly or in a lump sum, up to 55% of their homes' appraised value without jumping through the conventional mortgage qualification hoops. The sad reality in Canada is that people outlive their income by 10-12 years and more than 80% of Canadians not covered by a pension plan will run out of savings within five years - alternatives like reverse mortgages are crucial.

How it works:

A reverse mortgage is a loan that allows you to access your home equity payment free without having to sell your home. This is sometimes called “equity release.” You can borrow up to 55% of the current value of your home.

A reverse mortgage is secured by the equity in your home and, unlike a normal mortgage or home equity line of credit (HELOC), it has modest requirements when qualifying in regards to income, debts, and credit score. If you take out a reverse mortgage, you can use the money to pay for anything you want, including day to day spending, home repairs, bills, or travel. Best of all, you won’t have to pay back the loan or interest until you decide to sell or transfer ownership of your home.

The maximum amount you’re able to borrow will depend on:

Age

Home’s appraised value

The lender you select

Thanks to the newest lender of reverse mortgages rates dipped under 4% for the first time in May of 2020 and at the time of this publication, it was sitting at 3.49% for a 1-year term, 3.79% for a 5-year term.

There are some important differences between the two providers of reverse mortgages and clients considering a reverse mortgage should speak to a mortgage professional to determine which offering is best for them.

Example: Illustrating interest charges

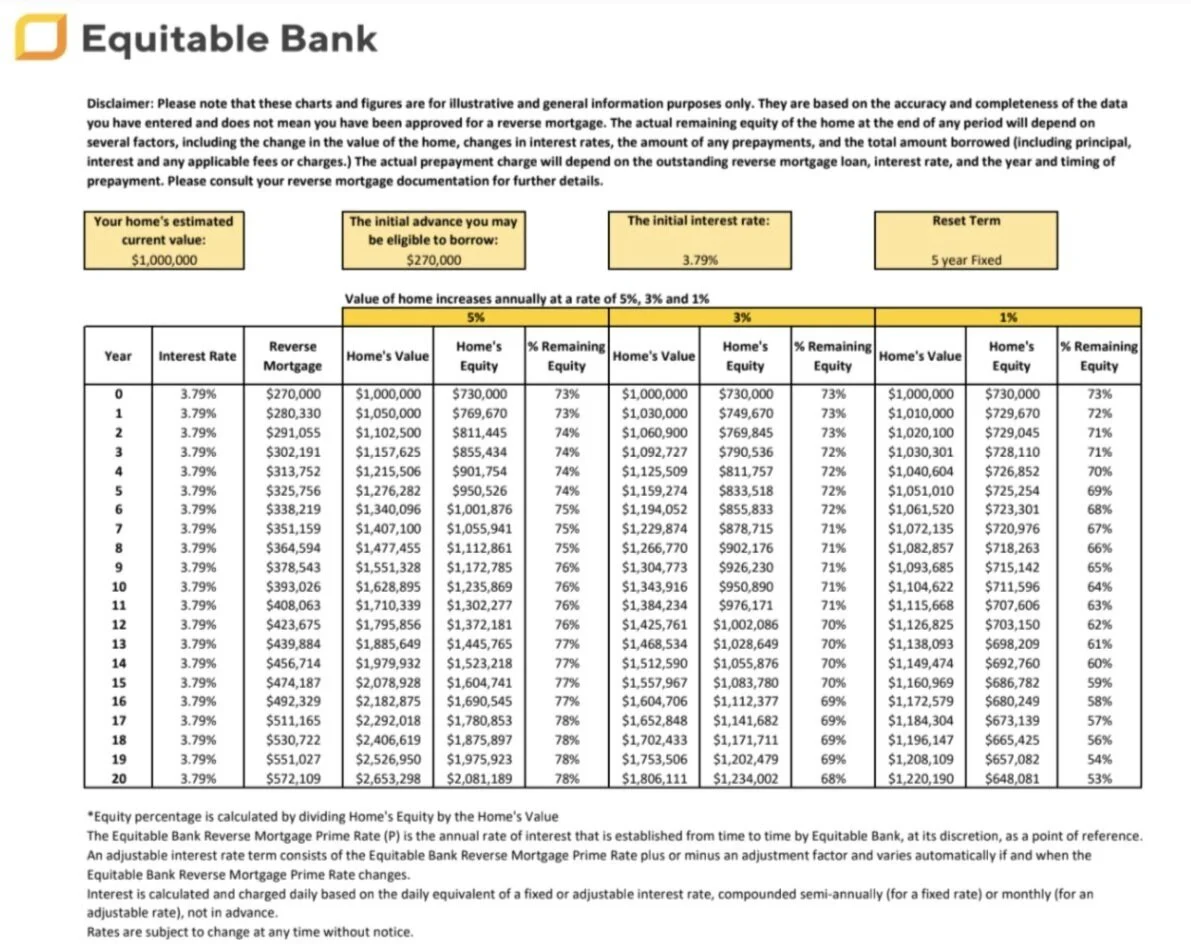

If you borrow $270,000 today on a $1,000,000 home at 3.79%, you will owe $393,026 at the end of 10 years inclusive of compounding interest. Consider that your home will appreciate at various rates throughout the time you live there. The chart below illustrates home appreciation at 1% 3% and 5%, you can see how not only should you have equity left but that you may have more equity in your home than when you started. (see the 5% example)

Source: https://www.equitablebank.ca

Costs associated with a reverse mortgage may include:

A higher interest rate than for a traditional mortgage

A home appraisal fee

A setup fee

Prepayment penalty. Reverse mortgages have a unique penalty structure which you should talk to your mortgage broker about

Legal fees for closing costs

The costs will vary depending on your lender, however the only fee you should have to pay before closing is the appraisal fee. Depending on the specific transaction you should expect fees to range from $2,200 to $3,000.

The benefits of a reverse mortgage:

You don’t have to make regular mortgage payments of course! It’s done in reverse where you get lent the money

It’s easier to qualify so if you have been declined at your bank won’t hesitate to consider a reverse mortgage even if your income is reduced in retirement

You can decide how you want to receive the money – you can take it as a lump sum, a regular payment, or a combination of the two

You maintain ownership of your property

The money you borrow is tax-free and doesn’t affect your Old-Age Security or Guaranteed Income Supplement

You don’t have to pay back the loan or interest costs until you decide to sell or should the last borrower pass away or transition to a move-out

You can pay interest monthly and you do have a 10% prepayment privilege annually

The potential risks of a reverse mortgage:

Reverse mortgages can increase the amount of debt you carry, meaning, there is less to leave to your family or other benefactors of your will

As you borrow more and more equity, interest starts to accumulate faster on a bigger amount due to compounding interest

You’ll be subject to a penalty if you sell the home within a certain period of taking out the reverse mortgage - this is an important difference between the two reverse mortgage lenders

1st year: 5 months interest or 5% of the mortgage amount

2nd year: 4 months interest or 4% of the mortgage amount

3rd or 4th year: 3 months interest or 3% of the mortgage amount

After the 5th year, you can take extended to a 6 month term and then pay it off penalty free

After the 6th year, you can pay out as long as there is a 90 days written notice

If you pass away, the amount you borrowed plus interest must be repaid within 6 months of time

Addressing misconceptions and outdated views:

In recent years, reverse mortgages have gotten more versatile alongside more affordable. Below are some facts that were not always true as reverse mortgages were introduced to people decades ago:

Homes with existing mortgages are now eligible

There is never a medical check

Proceeds are tax-free

As long as you have met your mortgage obligations, the amount you owe on the due date will not be more than the fair market value of your home

So long as you live in the home, keep it insured, pay your property taxes/condo fees and keep your home in a reasonable state of repair will not be asked to move or sell

How to be eligible:

You are Canadian and are aged 55 and over

You live in a major urban center in British Columbia, Alberta, Ontario, or Quebec

You live in your home for more than 6 months per year

Your home’s value is at least $250,000

All title holders of the residence apply as joint borrowers

THE BOTTOM LINE

Reverse mortgages are a fantastic way to access funds in a home without needing to resort to credit cards or private mortgages at much higher rates. Since new lending restrictions can make it difficult for applicants to qualify for conventional mortgages with rates around 2%, this is usually the best next option to finance outstanding bills and much-deserved leisure time. Before committing to one, it’s important to understand the upfront costs, costs for breaking the mortgage, and how much you will need to pay back when the home sells.