Want to find out more about mortgages?

Search by topic, keyword or phrase

Popular questions:

How Is a Mortgage Broker Different from a Bank?

The people that most rely on mortgage brokers are those who cannot qualify for mortgages with banks because of low declared income (usually by being self-employed), bruised credit, or have too much debt or leveraged properties to pass strict bank policies.

How Do Banks Differ with Non-Bank Prime Lenders?

Banks typically invest in the non-bank lenders so you can be rest assured that they are legitimate and backed by the right people. Banks are worth considering if you want to take out a Home Equity Line of Credit (HELOC) or invest in multiple properties. Banks however, have typically 3x higher mortgage penalties (some have been up to $45,000), typically less specialized mortgage advisors, higher rates, and less products available.

RESOURCES:

What Effect Has the Novel Coronavirus (Covid-19) Had On Mortgages?

RESOURCES:

What Is a Mortgage Pre-Approval and How Does it Benefit Me?

WHAT:

WHY:

EXAMPLE OF HOW YOU CAN SAVE $10,000:

Here is the quick math on the money you would have saved:

On a 5-year term at 2.10%: $1,413.36/month and $84,801.60 total

On a 5-year term at 3.10%: $1,578.69/month and $94,721.40 total

-------------------------------------------------------------------------

Save $9,919.80 for 28-minutes of your time!

RESOURCES:

What First-Time Homebuyer Programs Should I Be Aware Of?

RESOURCES:

How Do Mortgage Penalties Work and Who Charges the Least?

- Needing to refinance and pull money out against home equity

- Moving cities (credit unions don’t let you move without paying fees)

- Getting a divorce

- Selling your house

- Switching lenders for a lower fee (which may or may not be worth it long term)

RESOURCES:

- The Globe and Mail Article: When it comes to mortgage break penalties, big banks are often the worst

What is The Fastest Way to Pay Off My Mortgage?

Firstly, it’s important your mortgage lifespan, that is, your amortization is 25 years to start and that you have “20/20” privileges. What does this mean? This means you can pay off up to 20% of your total mortgage amount each year with one bulk payment alongside you are allowed to increase your monthly mortgage payment by 20% (again, you can only decide this amount once a year). Non-bank lenders usually do 15% or 20% and banks typically allow 20%. Lastly, consider having an accelerated payment option when signing up for a mortgage. This lets you make weekly or biweekly payments while putting about the same amount of money toward your mortgage as a monthly payment.

Accelerated payments will save you money on interest charges as you make the equivalent of one extra monthly payment per year. You’ll likely not notice a massive difference in the number of your payments, however, it will save you a lot of money in interest.

How Do Private and Alternative Lenders Work?

As of the time of writing, Alternative Lenders usually charge four to six percent interest, while Private Lenders charge six percent and up. Both usually charge an up-front lender fee of 1% or more.

You always want to have an exit plan with these lenders so make sure your trusted mortgage advisor and you align on a plan before you sign up with this kind of lender.

RESOURCES:

How Does Refinancing Work?

RESOURCES:

How Can Self-Employed People Get a Mortgage?

- Lenders look at your income after you do tax write-offs so getting taxed less means affording less on your mortgage

- In October 2018, the government passed a motion that you must prove two years of income to be considered

The solution for those who are self-employed is to work with a lender that is most tailored towards you - this will typically not be your local legacy bank. Many of these banks will be alternative and private lenders which act as a great starting place to get into the real estate market and as you build more income and tenure, you can quickly switch to a prime lender.

RESOURCES:

How Can Newcomers to Canada Best Get a Mortgage?

RESOURCES:

- Newcomers to Canada: Everything You Need to Know About Buying a Home

- If you are hispanic, watch this video explanation in Spanish

Should I Choose a Fixed Or a Variable Rate Mortgage Rate?

Your mortgage payments either fluctuate with fluctuations in the prime rate, or the interest portion of the payment varies - it depends on what lender you work with.

RESOURCES:

- The Globe and Mail Article: Fixed or variable? The coronavirus crisis has made one the better pick for mortgage shoppers this spring

How Does the Mortgage Stress Test Work?

The main reason for introducing the stress test is because Canadians carry a lot of debt. The government wants you to prove you can handle higher mortgage rates when they arrive in the future. There is a big debate on whether qualifying at a mortgage rate two percentage points higher is fair.

In order to pass the mortgage stress test, you will need to qualify at your contracted mortgage interest rate plus 2% or the Bank of Canada’s current five-year benchmark rate, whichever of the two is greater. As of this writing, the Bank of Canada’s five-year benchmark rate is 5.04% (which was lowered in mid-2019 and again during COVID-19). For example, if you are applying for a mortgage at a rate of 2.20%, then your lender will assess you as if you were paying your home loan at 5.04 since 4.20% (2.20% + 2%) is lower than the Bank of Canada’s five-year benchmark rate.

There was an amendment to the stress test scheduled to be activated on April 6, 2020 however, it has been delayed indefinitely until the COVID-19 crisis is controlled - see the interview below.

RESOURCES:

How Does Credit Score Work and How Do I Keep It High?

- What: Your history of paying bills on time is weighted as 35 percent of your total score.

- What: Out of your total credit available, how much are you using? Maxing out your credit cards will damage your score. It’s suggested that you use no more than 40 percent of your available credit.

- What: The age of your oldest account matters because lenders like to see that you’re responsible and consistent over time.

- What: When a bank or lender makes an inquiry about your credit to determine your creditworthiness, you will get points against your credit score.

- What: Too few or too many credit vehicles open, and active credit cards can influence your credit score. Vary your loans between car loans, different types of credit cards such as department store cards, and mobile phone plans.

RESOURCES:

Do All Credit Score Checks Lower The Score?

When things get more official, I will do a hard pull which is when a lender or company requests to see your credit. It does affect credit score but, much less than you think...it's 2 out of 900 points! All hard pull inquiries will show on your credit reports, but generally only one within a 45-day specified period of time will impact your credit score those 2 points I mentioned.

Here is an article with more info on hard pulls: https://www.consumer.equifax.ca/personal/education/credit-report/understanding-hard-inquiries-on-credit-report/

If you want to learn more about keeping credit score high, see this article I wrote.

What and How Much is Mortgage Default Insurance?

The default insurance cost gets spread out throughout the duration of your loan so you don’t need to pay it out of pocket right away. Even once you own more than 20% in your home, it does not void this premium which you technically were charged in bulk when you owned less than 20%.

EXAMPLE:

What Minimum Down Payment Should I Budget For?

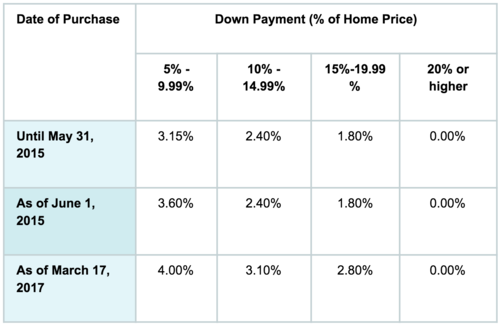

For the best prime lenders, see the below graph for an example of the different tiers:

RESOURCES:

Can I Keep My Same Mortgage Rate If I Sell My Home to Buy Something New?

What Are All Costs Associated With The Mortgage Process?

You must be prepared to pay most, and perhaps all, of the following closing costs.

Property Transfer Tax ($8000 on a $500,000 home) – The British Columbia Provincial Government imposes a property transfer tax, which must be paid before any home can be legally transferred to a new owner. The tax is charged at a rate of 1% on the first $200,000 of the purchase price and 2% on the remainder up to and including $2 million. The PTT is 3% on amounts greater than $2 million. Some buyers may be exempt from this tax.

Goods & Services Tax (variable) – If you purchase a newly constructed home, you may be subject to GST on the purchase price. There may be some rebates available depending on the value of the home. For further information, contact the Canada Revenue Agency at www.cra-arc.gc.ca

Property Tax (~$3000) – If the current owners have already paid the full year’s property taxes to the municipality, you will have to reimburse them for your share of the year’s taxes. These are usually due in July. Have your real estate lawyer investigate this.

Legal Fees (~$900) – The transfer of home ownership from the seller to the buyer must be recorded in the Land Title and Survey Authority Office in order to protect the new owner’s interests. You will probably want to engage a lawyer or notary public to act on your behalf during the completion of your purchase. The lawyer or notary public will charge a fee for this service, plus disbursements, including the Land Title Registration fee.

Appraisal Fee (~$350) – When the lending institution requires an appraisal of the home before approving your loan, it may be your responsibility to pay the appraiser’s fee. This typically happens when your down payment is over 20% and thus, you don’t have a mortgage insurer to cover this for you.

Title Insurance (~$150) – In its simplest form, title insurance protects the lender and homeowner against a number of risks related to the property’s title or ownership. With identity theft on the rise, it is not difficult for a fraudster to obtain legitimate identification claiming to be the true owner. The fraudster then deals with realtors and lawyers as if they were the owner and proceeds to sell the property. Alternatively, the fraudster may work with a lender or mortgage broker, again with identification, to place a new mortgage on the property. In either situation, the true owner is unaware of the fraud and the fraudster absconds with the sale or mortgage funds.

Other last-minute costs you shouldn’t forget to set some money aside for:

- home inspection fees

- moving expenses

- deposits required by utility companies

- household goods, like appliances and other equipment

- redecorating or renovations

If I Plan On Buying New Investment Properties, How Do I Ensure I Am Eligible For Enough Financing?

As you add on more mortgages and investment properties, your debt load increases and this makes it more difficult to qualify for mortgages - you want to reduce this.

- 1. Minimize mortgage debt: With a 30-year amortization or by making pre-payments regularly to pay off your mortgage, your monthly payment is reduced and your debt-to-income ratio decreases - this is a good thing. It goes without saying that you should also keep other debts down.

- 2. Save money: The more money you save for a down payment, the less mortgage you need and the less debt you will be carrying. This is correlated with borrowing more mortgages for new properties.

- 3. Rental Policies: Lenders have different policies to applying rental income to your qualification as some only use 50% of it while some use almost 100% of it. Make sure you aren’t always chasing a cheap rate if it means they have a bad rental policy and thus you cannot afford as much (hint hint: many banks).

What Is a Co-Signer Vs A Guarantor and What Risks Do Each Have?

A guarantor backs up someone taking out a loan and agrees to take over the payments in case the borrower defaults on the mortgage payments. Usually, guarantors are required if the primary borrower has credit score issues, but still has enough income needed to support payments. A guarantor’s name isn’t actually on the home title and does not have the same property rights as a co-signer would so it’s more “hands-off.” Technically, a guarantor does not need to be employed but they need to have enough assets on hand to bail out the primary borrower. Co-signers are typically spouses whose income is used to help qualify and are on the title of the property.

If you’re looking to pitch someone to be a guarantor beyond helping you out, this process can actually also improve their credit score assuming you pay on time. There are also many ways to remove them from the home title.