How Collateral Mortgages Help You Access Cash Without Breakage Penalties

A collateral mortgage is a type of mortgage product that is “re-advanceable,” which means the lender can loan you more funds as the value of your home increases without the need to refinance your home loan. In this case, your lender would register your property with a collateral charge, often for a higher amount compared to the loan amount required.

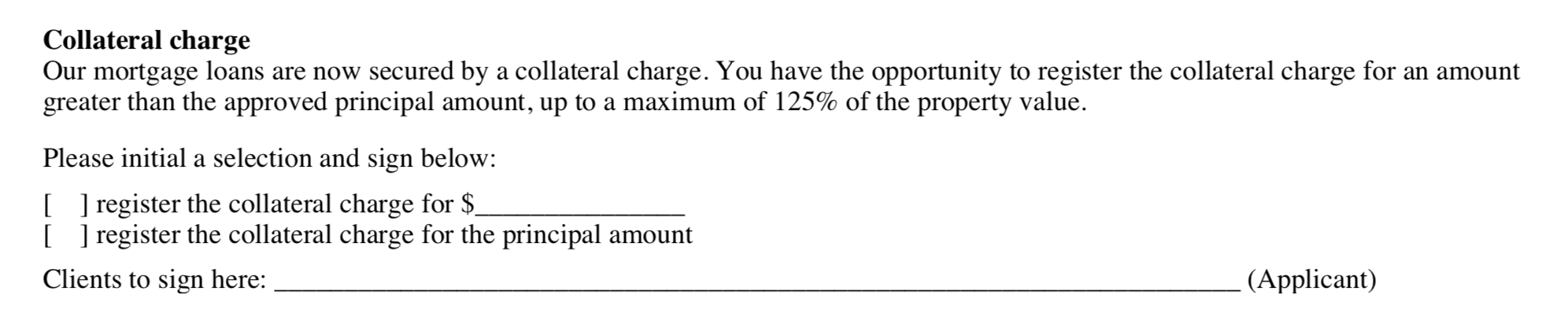

Many lender commitment letters will give you the option to register a collateral mortgage which I always strongly suggest to utilize to give you the freedom to pull out cash without refinancing in a way that breaks the mortgage and costs you thousands of dollars.

Commitment Letter Example:

Scenario #1: Renovation or Natural Appreciation adds $150,000 to home value

If you buy a $600,000 home with 20% down, your ceiling of future mortgage amounts is $750,000 (125% of $600,000).

To start, your down payment is $120,000 and $480,000 is the mortgage amount you borrow on the original value. In the scenario that a renovation adds $150,000 of home value, here is how you work out the math on how much cash you can access.

1. After your appraisal, assuming your debt and income ratios still qualify you, you can once again borrow up to 80% of the new value of $750,000.

2. Without breaking the mortgage by needing a refinance, you have 80% equity of the new value to work with, which in this case, is a $600,000 mortgage.

3. When you do a renovation or a new appraisal, your new equity available to use would be $600,000 minus your outstanding mortgage amount which we can keep at $480,000 to keep the math simple.

This means $120,000 can be used as free cash flow for an investment property or anything else you need.

Scenario #2: How to access the full Collateral Mortgage amount

To access the full $750,000 mortgage mortgage collateral ceiling amount, the value of your home would have to go up to $937,500 ($937,500 x 80% = $750,000) and you would have to owe nothing on your mortgage ($750,000 - $0 = $750,000).

If you still owed a mortgage of $475,691.48 for example, you could pull out $750,000 minus $475,691.48 which equals: $274,309 which can be used for the next investment property.

THE BOTTOM LINE

Collateral mortgages allow free access to pull out equity without breaking the mortgage. This flexibility is the key in times of crisis or when you are looking to expand your real estate portfolio quickly.